Book Keeping Task/Reconciliation

From PCSAR

(→Editing after reconciliation) |

(→Editing after reconciliation) |

||

| Line 15: | Line 15: | ||

[[Image:Edit reconciliation warning.png]] | [[Image:Edit reconciliation warning.png]] | ||

| + | |||

| + | {{standout box| | ||

| + | If you see this warning, '''think!''' | ||

| + | Do you really need to edit this transaction? | ||

| + | It will cause you extra work. | ||

| + | |||

| + | If you do in fact need to edit it, | ||

| + | how can you avoid this extra work in the future? | ||

| + | Could you have done the edit before the reconciliation? | ||

| + | Could you have caught the error during the reconciliation? | ||

| + | }} | ||

After making the change and before doing any other work in QuickBooks, check that the reconciled balance is still correct. | After making the change and before doing any other work in QuickBooks, check that the reconciled balance is still correct. | ||

Revision as of 21:07, 11 April 2018

The auditors for the 2014-2015 year noted: "All cash accounts should be reconciled at the end of each Bank Statement. This includes Casino and GIC accounts. All accounts should have a print-out proving reconciliations for each account, attached to the appropriate Bank Statement."

During the reconciliation process, don't just check the amounts. Also check (and if necessary correct) the date of the transaction.

Editing after reconciliation

Under normal circumstances, once a transaction is reconciled, it should not be further edited. Doing so can cause serious problems where the reconciliation is no longer valid, and it will take a lot of work to fix the problem. This one one of the major problems found during the 2016-2017 audit.

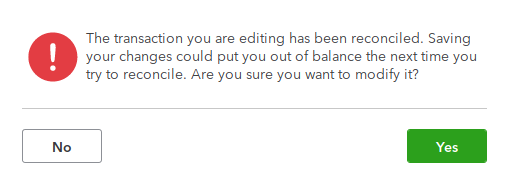

While editing (or deleting) an already reconciled transaction is occasionally necessary, it must be done carefully. When making the change QuickBooks will warn that you are changing a reconciled transaction.

If you see this warning, think! Do you really need to edit this transaction? It will cause you extra work.

If you do in fact need to edit it, how can you avoid this extra work in the future? Could you have done the edit before the reconciliation? Could you have caught the error during the reconciliation?

After making the change and before doing any other work in QuickBooks, check that the reconciled balance is still correct. You can check by selecting "Gear" > "Reconcile" and checking that the "Beginning balance" for the affected accounts match the closing balance on the last reconciled statements. If this is not the case, you must fix the reconciliation problem before making any other changes in QuickBooks. Failure to do so can dramatically increase the amount of work necessary to correct the problem later.